In this month's market report, we look at inflationary impacts on metal purchases, the oversupply of nickel, and futures pricing of steel, among other topics.

Consumer Price Index (CPI) data for November 2023, released on December 12, increased 0.1%, up 3.1% from last year. The headline CPI and core CPI (excluding food and energy) are above the Federal Reserve's target of 2%.

Do inflationary trends have an impact on metal purchases? Ryerson recently polled customers on this topic, among others. When asked how recent inflationary trends impact metal-buying decisions, roughly 40% of respondents indicated that inflation hasn't significantly affected their purchases.

However, about 45% stated that inflation has decreased their purchasing decisions in some way. Roughly 10% of those saying it has decreased their purchasing decisions indicate that it has done so significantly.

There's speculation in the market that the Fed may halt its actions to cool down the economy and inflation by the spring of 2024. However, opinions differ regarding whether the Fed will cut rates unless economic conditions significantly deteriorate.

The decline in oil prices is a potential contributor to reducing inflationary pressures, allowing for a potential "soft landing" in economic terms without plunging into a recession.

Crude oil prices have decreased roughly 26% decrease over the last month and a half. This price fall is attributed to factors such as increased oil production despite OPEC's announced supply and production cuts. The U.S. production increase counteracted the OPEC reduction, leading to a net global supply that hasn't seen a reduction.

The overarching concern is how these inflationary trends and potential Fed actions might impact the broader economy, including sectors like manufacturing, supply chains, and consumer behavior.

Nick Webb, Ryerson’s director of risk management, commodities hedging, provides a general state of the market for four industrial metals as we head into 2024.

Steel

Domestic steel prices surged by around $400 in the past few months, reaching approximately $1,050 in early December. Multiple price hikes have been announced since September, and further increases might occur based on scrap data or other factors, although this isn't a certainty. Overall, the most significant factors contributing to the increase appear to be lower capacity utilization, limited imports, and significant domestic stockpiling.

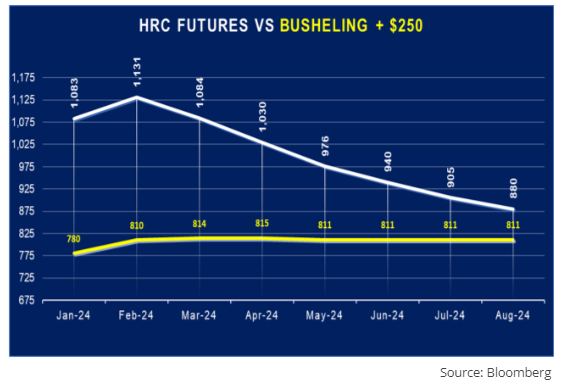

According to Webb, current steel prices seem to surpass the justified cost based on factors like power, natural gas, and scrap metal costs, indicating a relatively fair value of around $800 for hot roll steel.

Futures data suggests an upward price trend, peaking around February 2024. This pattern appears to be what was observed earlier in the year when prices peaked in April. This could possibly indicate a short-lived surge unless there's a change in demand dynamics.

Aluminum

The aluminum market has been relatively stable over the past 18 months, with prices remaining within the mid-90 cent range on the LME (London Metal Exchange) during this timeframe.

Webb notes that the aluminum market was showing some signs of a potential shift upwards, but that optimism faced a setback when the financial ratings agency Moody's downgraded China's credit rating from neutral to negative.

This is significant because China constitutes a significant portion (50-60%) of the overall aluminum demand. Such changes in perception or financial status have notable impacts on commodities, including aluminum. Additionally, the Bloomberg Commodity Spot Index hit its lowest level since August 2021, indicating a general downward trend in commodity prices, including aluminum.

The Midwest Premium for aluminum has also remained flat, hovering on either side of 20 cents for an extended period.

Additionally, discussions regarding an anti-dumping case in aluminum extrusions are ongoing, with expectations that its implementation will impact the availability of imported extrusions. However, a timeline for a decision on this matter remains uncertain.

Nickel

As opposed to aluminum, the nickel market has been anything but stable in 2023, buoyed by a continuous increase in supply, mainly from Indonesia. This surge in supply has led to significant surpluses, with estimates suggesting that up to 25-30% of the global nickel market may be added over the next 12 months.

Barring a slowdown in Indonesia's mining activity, this surplus is expected to persist, causing downward pressure on nickel prices, according to Webb. This, in turn, would likely result in decreased stainless steel surcharges. Traders have been positioning more bearishly, anticipating further price decreases due to these fundamental supply dynamics.

Copper

Significant news has emerged in the copper market as the Panama government recently ruled that the operation of Canadian mining company First Quantum’s copper mine in the country was unconstitutional.

The shutdown of this mine, which accounts for approximately 1% of the world's copper supply, has sparked some momentum in the price of copper. This situation might lead to a tighter copper market, especially as global economies pivot towards green technologies, potentially increasing demand for copper.

.ashx?h=300&w=940&hash=DEECD6B6BA67041B4A272456E756460A)