.ashx?h=300&w=940&hash=7C253D6B137646DC9543DC0F85775280)

Strategic planning in manufacturing hinges on insightful foresight and industry pulse checks. With the heartbeat of American manufacturing in mind, we surveyed our customers to gauge their perspectives and projections on various topics for the year ahead.

Nearly 1,000 customers shared their thoughts on anticipated metal purchasing behaviors, the state of American manufacturing, and the prevailing challenges foreseen in fabrication, supply chain, and labor shortages, among other topics.

This data serves as an invaluable roadmap for manufacturers and metal procurers alike. As the tides of the manufacturing landscape continue to ebb and flow, these insights stand poised to guide strategic decision-making, offering foresight and clarity in navigating the complexities that lie ahead in 2024.

After reading the results below, we invite you to join us for ENGAUGE 2024, an exclusive online event on February 1 tailored to empower manufacturers with the strategic foresight necessary to navigate the intricacies of the metal market in 2024.

Engage with industry thought leaders, gain actionable insights from the survey findings, and harness expert strategies to fortify your plans for the year ahead.

Your Business, Your Metal

PMI (Purchasers’ Managers Index) data throughout most of 2023 suggested a marginal and sluggish trend in U.S. manufacturing growth. Overall, it implied a lack of significant improvement or decline, marking a period of slow growth or stagnation in U.S. manufacturing.

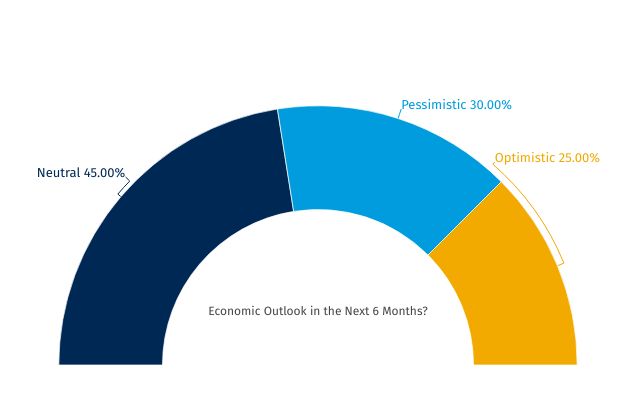

We asked about the outlook on the North American economy in the next six months. The majority (45%) remain neutral in their outlook. However, 30% are pessimistic about the first half of the year.

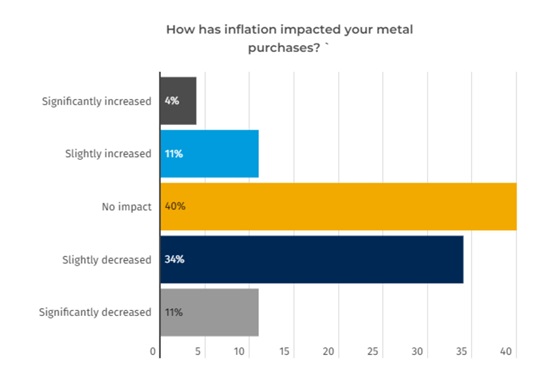

Inquiries about the influence of recent inflationary trends on metal-buying choices revealed that approximately 40% mentioned negligible impact on their purchases.

Contrastingly, around 45% acknowledged that inflation has, to some extent, reduced their buying decisions. Among this group, roughly 11% emphasized a significant decrease in their purchasing choices due to inflation.

For further insight into the impact that inflation has had on metal purchasing, check out this clip from Cup o Joe, Ryerson's monthly metal podcast, where we broke down the results under the lens of broader inflationary conditions.

However, the prevailing pessimism surrounding the economy isn't hindering metal-spending sentiment among respondents.

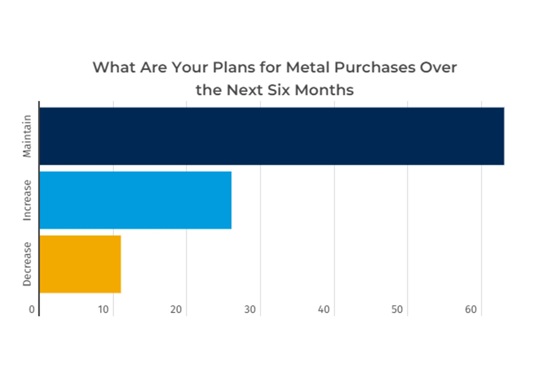

When asked about their plans to purchase metal over the next six months, 64% said they planned to maintain their current level of spending. Roughly 27% say they plan to increase their metal spending in the next six months, while only 11% planned to decrease their spend in this timeframe.

The data gets even more interesting when you cross-reference sentiment regarding the US economy with planned metal purchases in the next six months. Among the 30% who hold a negative outlook for the North American economy over the next six months, 61% intend to uphold their current purchasing levels for metal, while only 23% foresee a reduction in their expenditures.

Not surprisingly, of those who plan to decrease their spending on metal in the coming year, customer demand is the number-one indicator (60%), followed by metal prices (30%).

Looking at the complete set of respondents, when asked about plans to purchase metal over the next six months, 63% plan to maintain, while 26% plan to increase their spending.

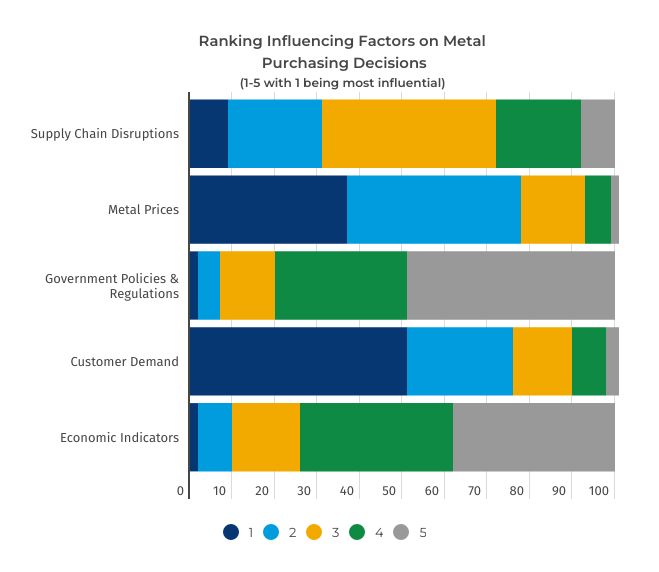

However, metal spending patterns aren't solely dictated by economic conditions. According to respondents, customer demand emerges as the primary influencer on metal purchases. Surprisingly, economic indicators rank fourth among influencing factors, following customer demand, metal prices, and supply chain conditions.

The Cost of Metal Fabrication

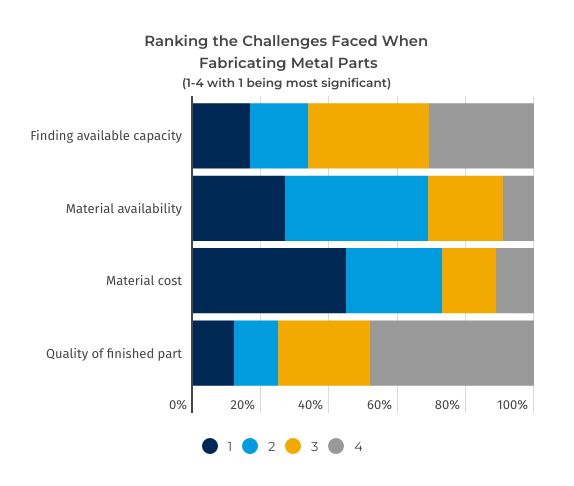

Metal prices significantly shape fabrication trends. When participants were tasked with prioritizing challenges in fabricating metal parts, 45% identified material cost as their foremost concern. Following closely, material availability was noted by 42% of respondents.

Despite this, locating accessible capacity remains a substantial worry, cited by approximately 34% as a top concern in metal part fabrication. However, this factor ranks third overall among the challenges faced in the process.

Supply chain disruptions, which impeded the market in recent years, might have eased somewhat in 2023. When questioned about the overall impact of supply chain disruptions on metal fabrication efforts in the previous year, 44% reported experiencing minor challenges.

Nearly a quarter of respondents acknowledged facing moderate challenges, whereas only 9% highlighted encountering significant challenges. Approximately 23% indicated that supply chain disruptions had no notable impact on their business in 2023.

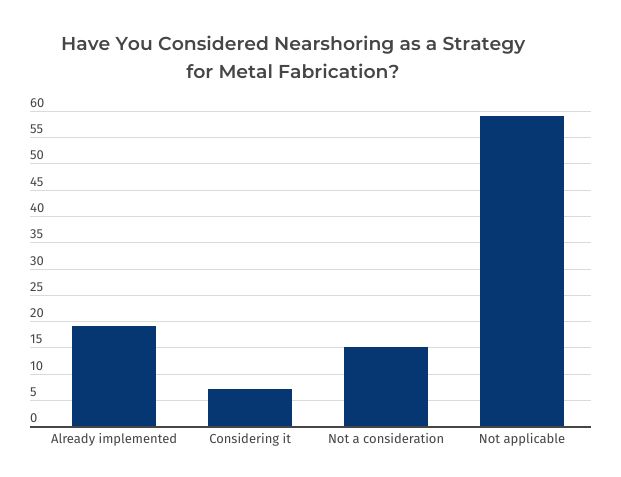

Of those respondents who cited some challenges from supply chain disruptions in the past year, 28% are either considering or have already implemented nearshoring (bringing production closer to home) as a strategy.

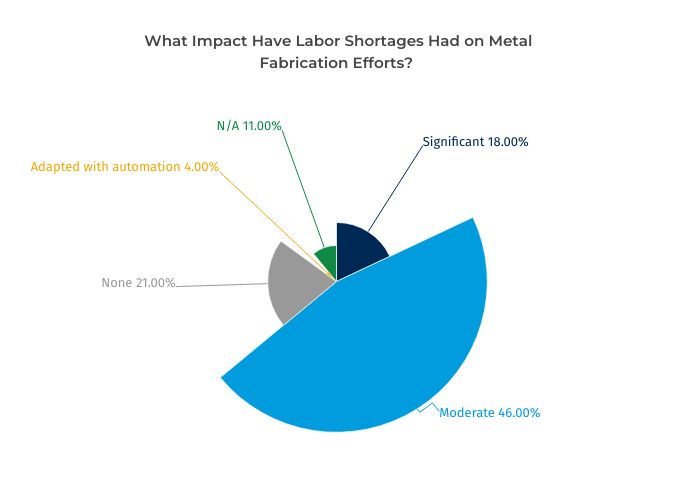

Respondents also identified labor shortages as a significant hurdle. The struggle to secure skilled labor has affected 68% of those surveyed in varying degrees over the past year.

Encouragingly, only 18% of this group perceive these labor challenges as substantial. This might suggest improved strategies to address the shortage of skilled workers. One such strategy was automation and technology, implemented by about 4% of respondents.

American Made, American Strong

The significance of American manufacturing remains an enduring concern within the metal industry. Previously, there was a prevailing notion that manufacturing in the U.S. was waning due to increased outsourcing.

We asked about perceptions of the current state of American manufacturing, which revealed diverse opinions among respondents. While 38% perceive it as stable, 30% view it as on the decline.

Among those who believe in the decline of American manufacturing, 10% foresee a reduced role for metal in the industry over the next five years, with a shift toward alternative materials. Additionally, 26% expressed uncertainty regarding the future role of metal.

However, most respondents expressed optimism regarding the role of metal in American manufacturing over the next five years. Approximately 27% anticipate its importance to surge due to expanded applications and increased usage, while 38% foresee it remaining relatively stable with slight alterations in usage.

Emphasizing the indispensable role of metal in fostering a sustainable and burgeoning global economy, it serves as the cornerstone of our surroundings, contributing significantly to job growth, GDP, and overall improvements in quality of life.

Manufacturing Planning for 2024

Amid pervasive uncertainty, Ryerson presents an invaluable opportunity to assist manufacturers in strategic planning for the upcoming year. Engauge 2024, scheduled for February 1, is a pivotal virtual event that will offer critical insights from primary influencers in the world of manufacturing and metals.

This event will showcase an economic forecast by an esteemed economist from ITR Economics, along with a comprehensive update on metal commodities by our director of risk management and commodities hedging.

A highlight of the event will be an insightful keynote presentation exploring the significance of Artificial Intelligence (AI) in the realm of manufacturing. This session aims to illuminate the transformative potential of AI, offering valuable perspectives for industry professionals seeking to harness technological advancements for strategic advancement.

Information contained in this report is the result of a customer survey conducted by Ryerson via email in November 2023 aimed at collecting information related to customer opinions on current market conditions. Respondents were metal buyers in manufacturing and metal fabrication across North America, representing various industries, ranging from industrial machinery to oil & gas to construction equipment, among others. It is the collated responses of 946 respondents during this period and not the opinion of Ryerson, its employees/officers/directors, or affiliates.

Would you like to receive monthly market intelligence from Ryerson? Sign-up to receive the Monthly Market Report, which features unique market analysis and insight from Ryerson market and risk managers.

Ryerson: The Metal Supplier of Choice

Ryerson is a leading North American metal supplier that provides more than just metal. We respond to the ever-changing needs of manufacturing today.

With a vast inventory of steel, stainless, aluminum, alloy, and more, we are committed to providing our customers with the metal and services they need to succeed. We stock a range of shapes and sizes, or we can provide processing and fabrication for every product we sell

Order online at Ryerson.com for comprehensive pricing and fast delivery, or contact us today to learn more about how we can meet your metal needs.

.ashx)

.ashx?h=300&w=940&hash=0A2BF5AA5098F53ADA3592F9D54062C4)

.ashx?h=300&w=940&hash=2619C2BDA6683F41E6A63C93578351EB)