Are the fundamentals in place for higher steel prices in the coming months? Even though hot-rolled steel prices have declined to their lowest levels of the year, futures data suggests that the market could be in a bottoming process, and we could see higher prices by the end of the year.

“There is a chance that, even though we are seeing demand destruction from the United Auto Workers Strike, the supply side of the equation does appear to be getting ratcheted in the opposite direction and may keep things tighter than we would have expected just a couple months ago,” says Nick Webb, Ryerson’s director of risk management, commodities hedging.

According to Webb, future contracts anticipate a move higher by approximately $150 to $200 as we enter Q1 of 2024. This range indicates a substantial price increase, which can have far-reaching implications for multiple industries that rely on steel.

Among the several factors contributing to this projection is capacity utilization at U.S. steel mills. Data from the American Iron & Steel Institute shows that in the week ending on Oct. 7, 2023, the domestic capacity utilization rate was 74.7%, down roughly 1.4% from the previous week.

In the face of slower demand due to the Auto Workers Strike, many mills are pulling various levers to adjust production levels in response to market conditions. This includes temporary shutdowns or maintenance activities, which we have seen from multiple steel producers recently.

The cumulative effect of these maintenance activities is a reduction in steel production, with annualized production potentially being reduced by millions of tons. While these actions may seem disruptive, they can help balance the supply side of the equation.

With regards to how high steel prices could rise, Webb adds, “I wouldn't say it makes total fundamental sense to see steel prices back in the $1,000/ton range, but it does feel as though we are in a bottoming process, even in the face of the auto workers strike.”

/Im-Ready-to-Buy.ashx)

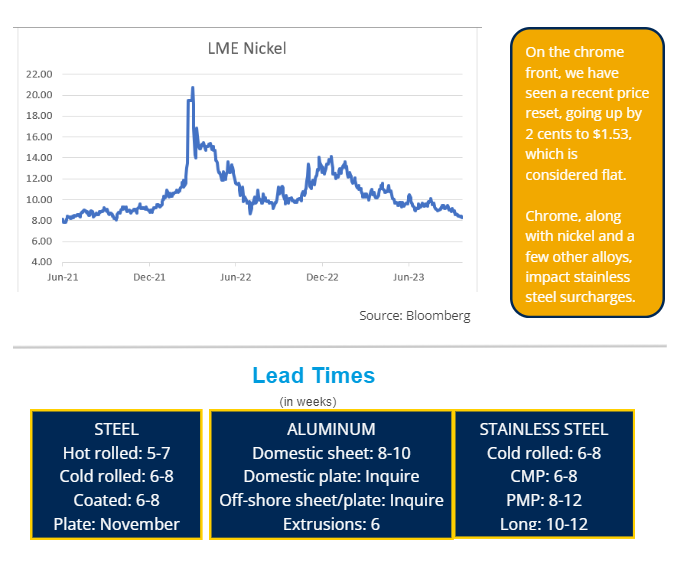

Nickel Supplies Remain Balanced

While steel and aluminum prices both seem to experience fluctuations almost daily, nickel has been on a consistent downtrend over 2023. As of early October, the price of Nickel is around $8/lb.

Much of this stems from the fact that the market is well supplied, driven by an anticipated influx of class one nickel and nickel pig iron production in Indonesia in the next 12-18 months.

The United States has a significant influx of stainless steel imports from Asia. This increased supply is expected to counteract the growing demand from markets like electric vehicles.

The London Metal Exchange (LME) has taken steps to enhance its inventory levels. While the LME inventory isn't back to previous levels, it's increasing, impacting nickel prices. It's worth noting that Class 2 nickel markets remain looser in terms of supply and demand.

Optimism for Aluminum

There has been a modest uptick in aluminum prices on both the London Metal Exchange and the Shanghai Futures Exchange as of late. Although the increase in aluminum prices is not substantial, there's evidence of a horizontal support level at around 95 cents per pound.

Some of this optimism comes from the Asian market, where specific sectors are showing signs of growth. When Asia's economy experiences growth, it significantly impacts the demand side of the aluminum equation, given that it accounts for a substantial portion of global aluminum consumption.

While China's property sector has faced challenges, industries like infrastructure, high technology products, and renewable energy projects like wind and solar farms are thriving. These projects consume substantial quantities of aluminum.

According to Ryerson’s Webb, market sentiment on aluminum has shifted from a bearish stance to a more bullish outlook in recent weeks. He says this change indicates that traders are closely monitoring the positive developments in the aluminum market, particularly those driven by growth in Asia.

Midwest Premiums have been on a gradual decline. However, thanks to tariffs and other factors, the decline is expected to stabilize around a "happy medium" for prices, likely within a range of plus or minus a few cents on either side of 20 cents.

Ryerson: The Metal Supplier of Choice

Ryerson is a leading North American metal supplier that provides more than just metal. We respond to the ever-changing needs of manufacturing today.

With a vast inventory of steel, stainless, aluminum, alloy, and more, we are committed to providing our customers with the metal and services they need to succeed. We stock a range of shapes and sizes, or we can provide processing and fabrication for every product we sell.

Order online at Ryerson.com for comprehensive pricing and fast delivery, or contact us today to learn more about how we can meet your metal needs.

/Im-Ready-to-Buy.ashx)